Accurate & Timely GST Return Filing Services

We provide reliable and timely GST return filing services to help businesses stay fully compliant with GST regulations in India. Our expert team ensures accurate reporting of sales, purchases, tax liability, and input tax credit (ITC), minimizing errors and avoiding penalties.

Whether you are a small business, trader, service provider, manufacturer, or professional, we handle your GST returns efficiently so you can focus on running your business.

Our GST return filing process begins with a detailed review of your financial data, ensuring all transactions are properly recorded and classified. We perform thorough data reconciliation between sales, purchases, and ITC, reducing mismatches and compliance risks.

We stay updated with changing GST rules, due dates, and compliance requirements, ensuring your returns are filed accurately and on time. Our team also assists with amendments, corrections, late filings, and response to GST notices, providing complete compliance support.

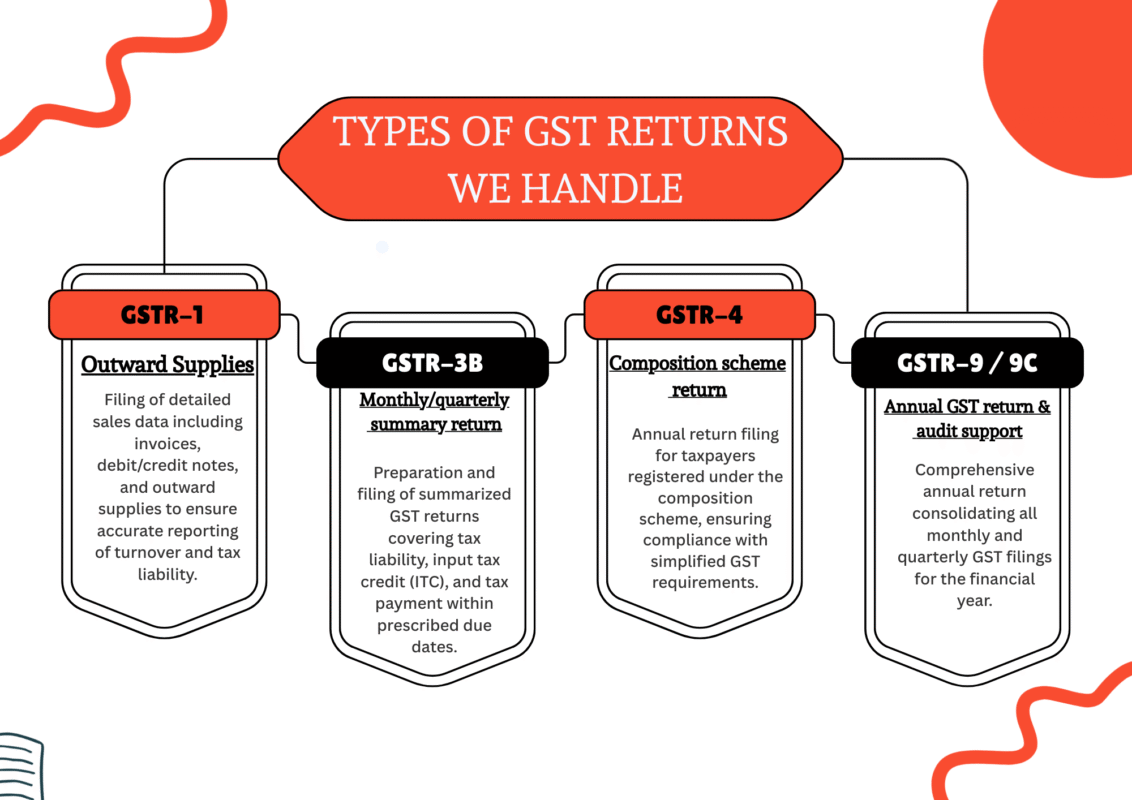

Monthly, quarterly, and annual GST return filing

Preparation and filing of GSTR-1, GSTR-3B, GSTR-4, and GSTR-9

Sales and purchase data reconciliation

Input Tax Credit (ITC) verification

Error correction and amendments

Late fee and interest calculation support